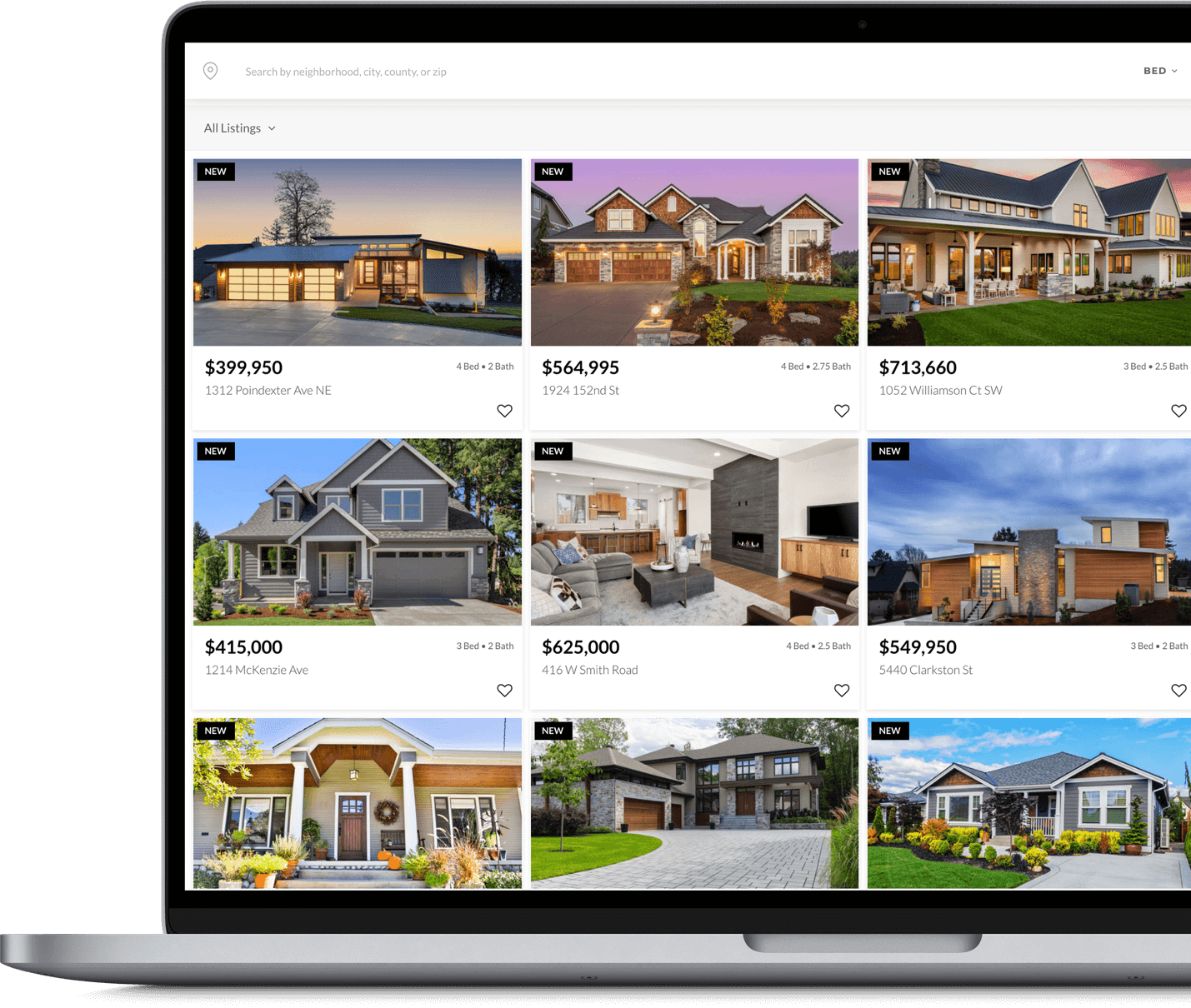

Start Your Home Search

Search for homes wherever you are

When buying a home, start by making a wish list and setting a budget. We can help you choose a lender to get you pre-approved for a loan, and then you're ready to start house hunting. Search for your dream home from any device on our website. You can even compare walk scores, school ratings, and neighborhood demographics for different listings.

Start Searching

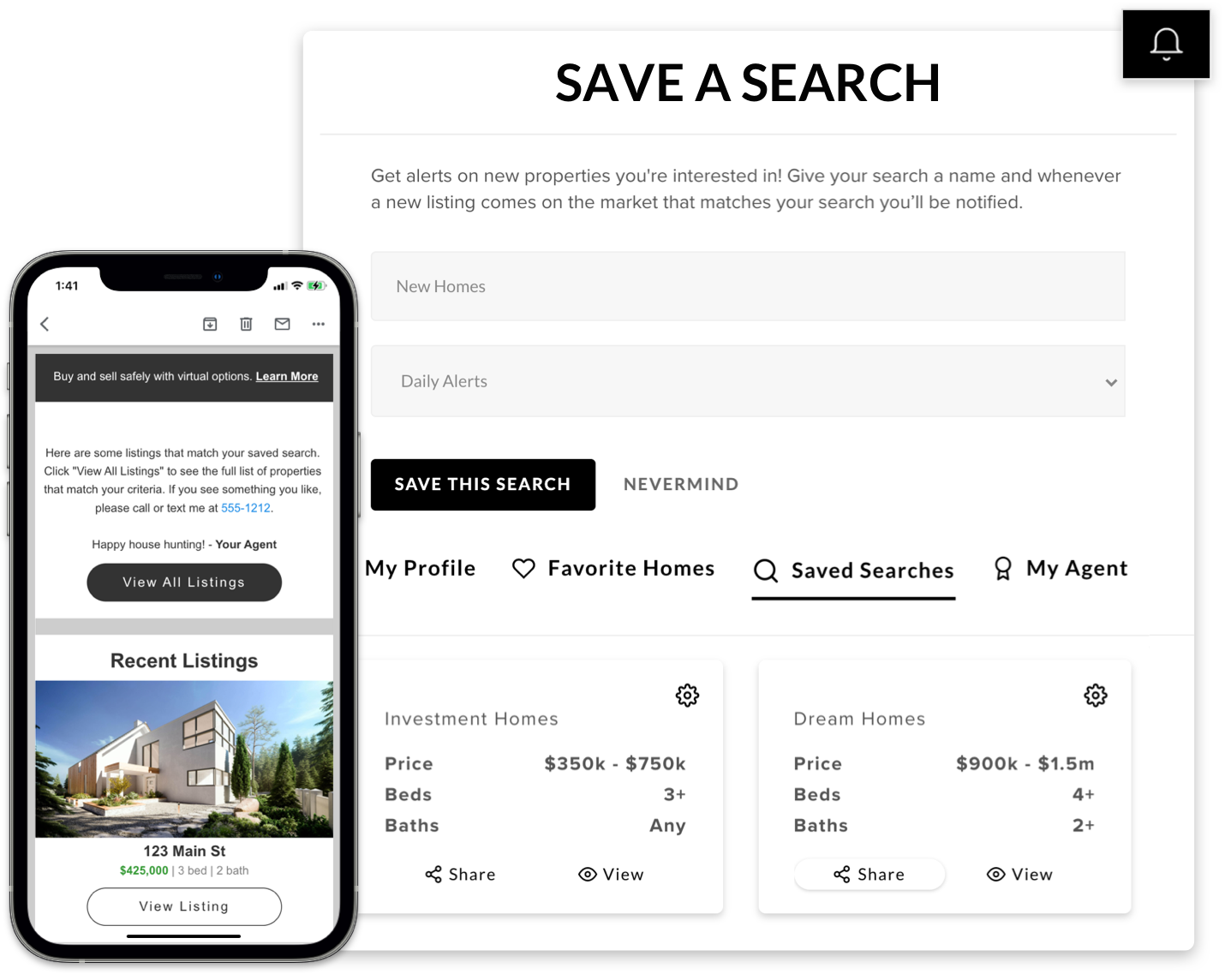

Get Listing Alerts

Be the first to know when a property hits the market

When you save a search on our site, any new homes matching your wish list criteria will be delivered straight to your inbox the moment they go up for sale.

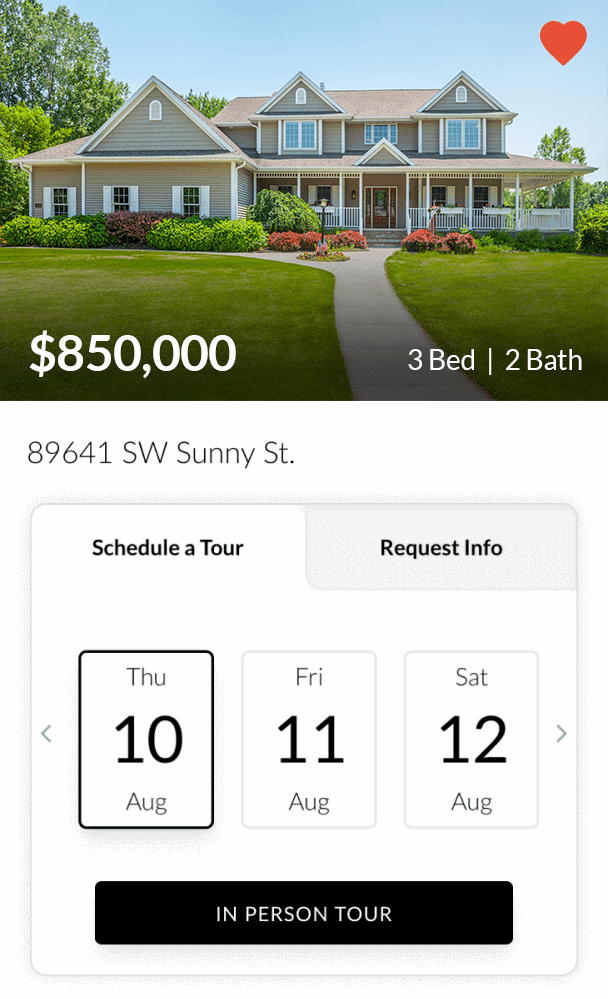

Save and See Listings

Favorite properties and tour homes

Click the icon when you find a house you love to save it in your favorites section and let us know you like it. Hit "See This Listing" or reach out to your agent directly to schedule an in-person showing. We're happy to walk you through the home and answer any questions, so you can make an informed decision.

Making An Offer And Closing

We're With You Until The End

Before the offer to purchase is created, it is very important that you have been at least pre-qualified or better yet pre-approved by a lender.

This is one of the best negotiating tools a buyer can have. It shows the seller that you are financially able to purchase the home. After you have found the right home, it is time to prepare the offer.

When you are buying a home, there are many problems that the seller is obligated to disclose. For example, in most states, it is illegal to withhold information about major physical defects on the property, but these disclosures don't always paint the entire picture of the home. Here are six questions you may want to ask that can offer additional insight about the prospective home before you make a final decision.

This question may help you evaluate the "real value" of the property. Is there something about the house the seller does not like? If so, you may be able to adjust the purchase offer accordingly.

This question can, in some instances, help the buyer negotiate a better deal-maybe even get the seller to carry part of the loan. However, it is important to remember that the purchase price is influenced by several factors, like the current market value and any improvements the seller may have made to the home. The original purchase price might not have anything to do with the current value of the house.

By asking the seller what he or she likes most and least about the property, you might get some interesting information. In a few cases, what a seller likes the most about a home might actually be something the buyer is looking to avoid. For example, if the seller describes his house as being in a "happening community," the buyer might consider this a negative factor because the area may be too noisy or busy for his or her taste.

It is also a good idea to ask the seller if he or she has had any problems with the home while living there. Has the seller had problems with a leakage from the upstairs bathroom in the past? If so, even if the leak has been corrected, the floor and walls around the bathroom might have been damaged. You should also check that these items were repaired properly.

Use this answer to find out about any noisy neighbors, barking dogs, heavy airplane traffic or even planned changes to the community, such as a planned street widening. This may give you insight on why the seller is really moving.

Because the value of a community is usually greatly influenced by the public schools in the area, finding out the buyer's perception can give you some insight about the quality of the area's schools.

Knowing all you can about a prospective home, not only helps you decide if it's the home of your dreams, but what offer to make as well. Your real estate professional can help you get your key questions answered and give you advice on how to evaluate your findings.

First Time Home Buyers

If you are a first-time home buyer, use the guide below for helpful hints and tips and learn how to avoid common mistakes when buying your first home in Plano, TX.

Meet with a mortgage broker and find out how much you can afford to pay for a home.

While knowing how much you can afford is the first step, sellers will be much more receptive to potential buyers who have been pre-approved. You'll also avoid being disappointed when going after homes that are out of your price range. With Pre-Approval, the buyer actually applies for a mortgage and receives a commitment in writing from a lender. This way, assuming the home you're interested in is at or under the amount you are pre-qualified for, the seller knows immediately that you are a serious buyer for that property. Costs for pre-approval are generally nominal and lenders will usually permit you to pay them when you close your loan.

Make 2 lists. The first should include items you must have (i.e., the number of bedrooms you need for the size of your family, a one-story house if accessibility is a factor, etc.). The second list is your wishes - things you would like to have (pool, den, etc.) but that are not absolutely necessary. Realistically for first-time buyers, you probably will not get everything on your wish list, but it will keep you on track for what you are looking for.

Consider hiring your own real estate agent, one who is working for you, the buyer, not the seller.

In a convenient location, keep handy the items that will assist you in maximizing your home search efforts. Such items may include:

- One or more detailed maps with your areas of interest highlighted.

- A list or file of the properties that your agent has shown to you.

- Paper and pen for taking notes as you search.

- A camera to snap pictures of homes you have toured to help you remember your favorites and features you really liked.

Are the rooms laid out to fit your needs? Is there enough light?

Instead of thinking with your heart when you find a home, think with your head. Does this home really meet your needs? There are many houses on the market, so don't make a hurried decision that you may regret later.

A few extra dollars well spent now may save you big expenses in the long run. Don't forget such essentials as:

- Include inspection & mortgage contingencies in your written offer.

- Have the property inspected by a professional inspector.

- Request a second walk-through to take place within 24 hours of closing.

- You want to check to see that no changes have been made that were not agreed on (i.e., a nice chandelier that you assumed came with the sale having been replaced by a cheap ceiling light).

All the above may seem rather overwhelming. That is why having a professional represent you and keep track of all the details for you is highly recommended. Please contact us directly to discuss any of these matters in further detail.